It is essential that you take legal action as an adult to protect your possessions and yourself. A trust, insurance, retirement planning, a living will, a power of attorney, a POD, and a debt management plan are a few examples. By putting these legal procedures in place, you can make sure that your wishes are honored and that you and your loved ones are safeguarded in the event of any unforeseen circumstance.

It’s also important to review these documents often to make sure they’re still useful and meet your needs. Some of the documents you need to have in place are:

A Will

A Last Will and Testament is a document that outlines how a person’s assets and property will be distributed after their death. A will should be in place to ensure that your desires are followed and that your loved ones are taken care of. You should also consider things such as hiring Pendleton’s wrongful death lawyer for any unforeseen circumstances.

It is recommended to review and update your will at least once every three to five years, or whenever a significant life event occurs, such as:

- Marriage or divorce

- Birth or adoption of a child

- Death of a beneficiary or executor

- Change in financial circumstances

- Acquisition or disposal of significant assets

Additionally, it is also a good idea to review your will after major changes in tax laws or estate laws, to ensure that your wishes are still aligned with the latest legal requirements. It is important to keep your will up-to-date to ensure that your assets are distributed according to your wishes after your death.

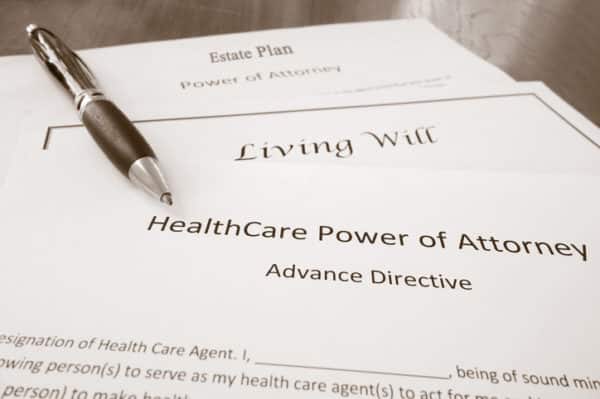

Your Power Of Attorney

A legal power of attorney is a document that gives another person the authority to make decisions on your behalf in the event that you are unable to do so.

There are two main types of Power of Attorney (POA) documents:

Durable Power of Attorney: This type of POA remains in effect even if the grantor becomes incapacitated or unable to make decisions for themselves. It allows the designated agent to make decisions on behalf of the grantor for financial, legal, or healthcare purposes.

Springing Power of Attorney: This type of POA only goes into effect in the event that the grantor becomes incapacitated or unable to make decisions for themselves. It gives the designated agent the power to make decisions for the grantor only in specific circumstances, as specified in the POA document.

It is also possible to have a Limited Power of Attorney, which gives the designated agent authority to make decisions in specific, limited circumstances only.

It is important to understand the different types of POA documents and the implications of each, before choosing one and signing it. A lawyer can provide guidance and advice in this matter.

A Living Will

A Living Will is a legal document that outlines an individual’s wishes for medical treatment in the event that they become unable to make decisions for themselves. It typically includes instructions for end-of-life care, such as the use of life-sustaining measures, and is meant to ensure that an individual’s medical wishes are followed even if they are unable to communicate.

To get a Living Will, you can either:

Hire a lawyer to draft the document for you. This ensures that the document is legally binding and meets all the necessary requirements for your state or jurisdiction.

Use a template or a service that provides Living Will forms. You can find these online or at a local stationery store. However, it is important to ensure that the form you use is legally recognized in your state or jurisdiction and that it meets all the necessary requirements.

It is important to have a Living Will in place to ensure that your end-of-life wishes are respected, and to help your family and medical team make decisions about your care in the event that you are unable to do so.

Your Advance Directive

An Advance Directive, also known as an Advance Health Care Directive, is a legal document that outlines an individual’s wishes for medical treatment in the event that they become unable to make decisions for themselves. It typically includes instructions for end-of-life care, such as the use of life-sustaining measures, and is meant to ensure that an individual’s medical wishes are followed even if they are unable to communicate. It is often confused with a Living Will.

A Living Will is a specific type of Advance Directive that only addresses end-of-life care and treatment. An Advance Directive, on the other hand, can include a Living Will, as well as other instructions and designations, such as the appointment of a Health Care Proxy, who will make medical decisions on the individual’s behalf if they are unable to do so.

In summary, a Living Will is a subset of an Advance Directive, which provides more comprehensive instructions and designations for medical treatment in the event of incapacity.

Having an Advance Directive in place can ensure that your medical wishes are respected and that your family and medical team are guided by your instructions in the event that you are unable to make decisions for yourself. It also helps to take the pressure off of your loved ones so they do not have to make the hard decisions.

Trust Details

Whether or not you need a trust depends on your personal financial situation and goals. A trust is a legal arrangement where a trustee holds and manages property or assets for the benefit of one or more beneficiaries.

Some reasons why you may consider setting up a trust include:

To avoid probate: A trust can help you avoid the time and expense of probate court proceedings, as assets held in a trust pass directly to the beneficiaries without the need for court approval.

Estate planning: A trust can help you manage and distribute your assets according to your wishes, even after your death.

Asset protection: A trust can provide protection for your assets from creditors, lawsuits, and other financial claims.

Tax savings: A trust can provide tax savings by allowing you to transfer assets to beneficiaries in a tax-advantaged manner.

It is important to carefully consider your financial goals and needs, and to seek professional advice from a financial planner, attorney, or tax professional, before setting up a trust. This can help you determine whether a trust is a right choice for you and ensure that the trust is set up in a manner that meets your needs and goals.

Insurance

The types of insurance that you need can vary depending on individual circumstances such as income, assets, health, family, and personal preferences. However, here are some of the most common types of insurance that many adults have:

Health insurance: Health insurance helps cover the cost of medical care and can protect against financial burdens in case of unexpected medical expenses.

Life insurance: Life insurance provides financial protection for your loved ones in the event of your death, ensuring that they have access to the resources they need.

Auto insurance: Auto insurance provides coverage for damage to your vehicle, as well as liability protection in the event of an accident.

Homeowners or renters insurance: Homeowners insurance provides coverage for damage to your home, as well as liability protection in case of accidents on your property. Renters’ insurance provides similar coverage for renters who do not own their own homes.

Disability insurance: Disability insurance provides a source of income if you become unable to work due to an injury or illness.

Umbrella insurance: Umbrella insurance provides additional liability coverage beyond the limits of your other insurance policies, such as auto or homeowners insurance.

It is important to assess your personal circumstances and insurance needs and to speak with an insurance professional to determine the best insurance coverage for you. Keep in mind that insurance needs may change over time, so it is a good idea to review and update your insurance coverage on a regular basis.

Retirement planning

Making sure you have enough money to live on when you stop working requires careful consideration. This entails opening a retirement account, like a 401(k) or IRA, and making regular contributions to it. We have lots of tips ad information on planning for retirement on our website. Check out Retirement

Cybersecurity

With more and more personal and business information being stored online, it’s important to have cybersecurity measures in place to protect yourself from hacking and data breaches. This can involve creating secure passwords, turning on two-factor authentication, and keeping your security software up to date. You also need to have a plan for your digital assets in the event of your death. We have an article that gives tips on estate planning for your digital assets.

As an adult, it’s critical to have these legal arrangements in place to ensure your safety and that your preferences are respected in the event of an accident or other unforeseen circumstance. It’s also important to look at these documents on a regular basis to make sure that your needs are still being met and that your preferences are still valid.