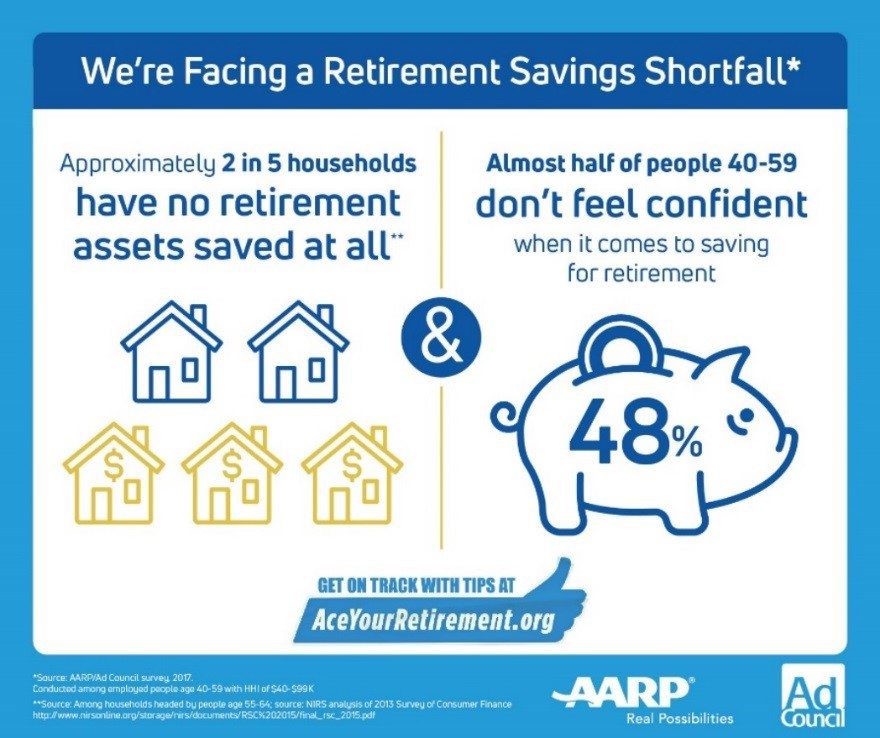

The new year is right around the corner. And while our minds are on the holidays and how we can save on gifts we buy for others, we need to think about ourselves and saving for retirement. Too often women are left with nothing but social security in old age. We spend our lives giving to others and putting others first and in the end, we are left depending on our children or living on a limited social security income. Now is just as good a time as any to start thinking about yourself.

When is the last time saving for retirement crossed your mind? Are you that person who thinks they have a good plan because their savings from each paycheck are on auto-pilot, or are you waiting until you’re “older” to start investing? Do you think you don’t have enough money to save for retirement? Do you think you have time to put off planning?

Even though it feels like a daunting task, you really shouldn’t be putting off saving for retirement until you are older, especially if you’re in your 20s or 30s. It only makes sense that the sooner you start, the better. But for some of us, life just tends to get in the way. For others, it can be hard just paying the bills and everyday finances that come with being an adult let alone saving for anything.

Even if you have your retirement contributions set to come out of your paycheck automatically, it’s still worth taking the time each year to make sure that your plan is still solid and see if you can find a way to increase those contributions. You should always be looking to get the most out of your retirement fund because when it comes time to retire you want to feel like you have a secure financial future.

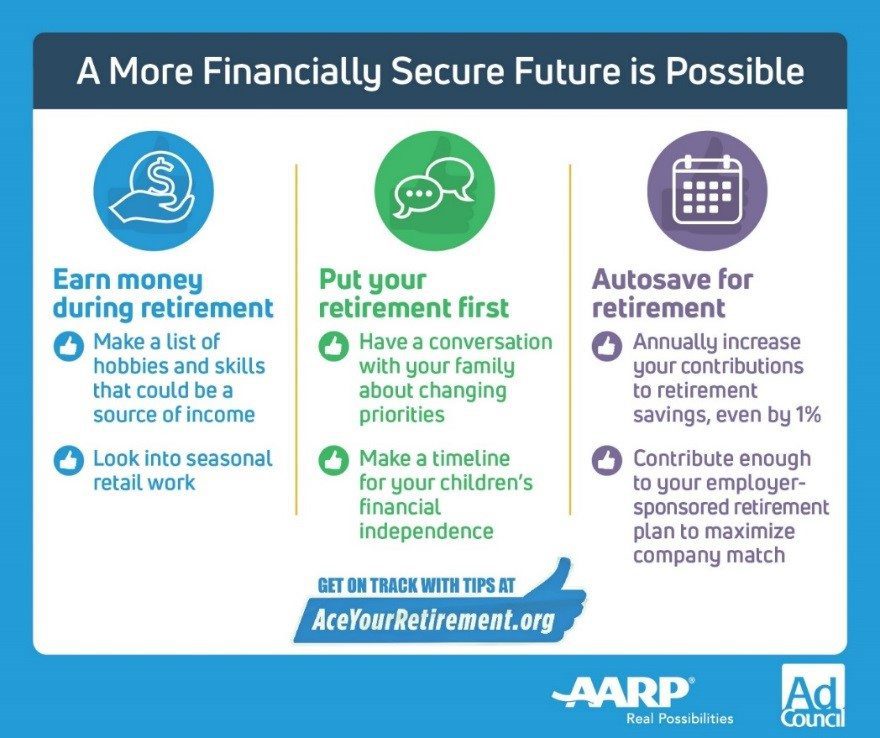

Tips to consider to help you maximize your retirement savings:

• While gathered with your family for the holidays, discuss your savings plans and long-term retirement goals, and what you can do today to achieve them. It’s important for everyone in the family to be on the same page about your financial goals and priorities.

• Start planning now what age you plan to retire and when you plan to start taking your Social Security benefits. You can seek the advice of retirement plan advisors to help you develop a plan for retirement. Earning a few more years of income could really help you grow your nest egg, and delaying when you start collecting Social Security increases your annual benefit.

• If your employer offers matching funds for your retirement savings plan, make sure you’re contributing at least enough to get the full employer match.

• Brainstorm ideas for earning money in retirement, such as turning a hobby into a source of income, investing in the stock market, trading mit Kryptocoins or taking on seasonal part-time work

• Visit AceYourRetirement.org to get your personalized action plan in just three minutes. Your digital retirement coach, Avo℠, will reveal the top three simple, practical things you can do right now to make sure your retirement plan is on track.

Stop Putting off the Inevitable – Start Saving Today!

As a woman of a certain age, in my fabulous 50’s, I am concerned about retirement. I have worked and raised four children living mostly paycheck to paycheck and have nothing saved. Who can think about saving when you can’t even pay the bills that are coming in? Not this one. So listen to me when I say put yourself first now, even if it’s just $10 a month it can add up. Then sooner you start saving the more money you will have for retirement. If I had put $10 a month in an account when I started working at age 18, imagine how much I would have at retirement. Now think about if I had invested that money or just let interest accrue. Don’t be me, listen to what I tell my children and start saving now!

Okay, now for those of us like me who are looking at retirement with nothing saved, there is a way but you have to start today. Take a few minutes and see what Avo can tell you over at AceYourRetirement.org I did and here is one of the tips Avo had for me:

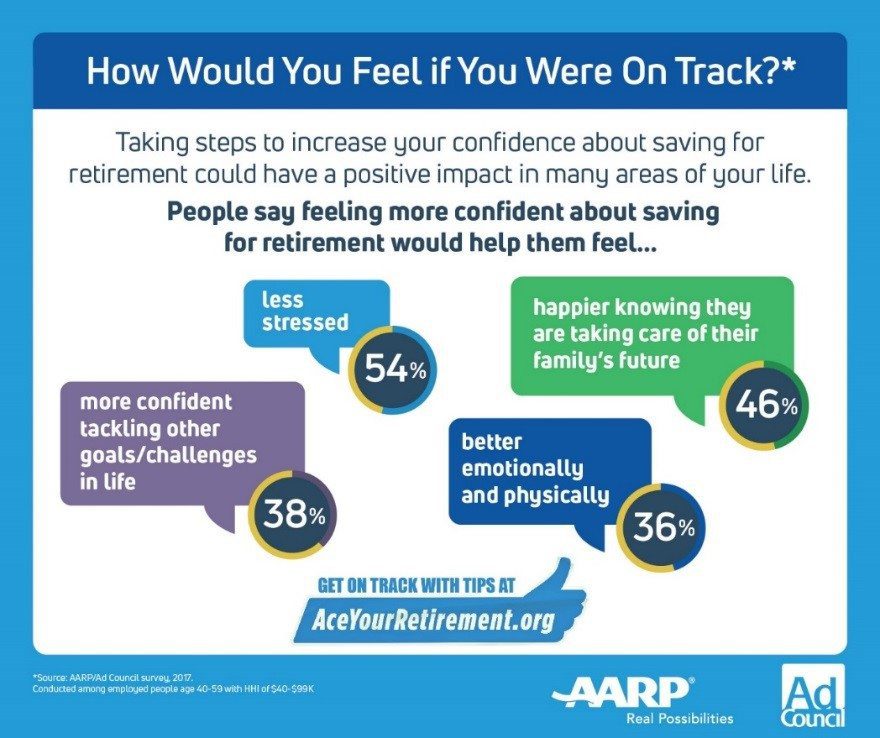

Taking steps to take control of your retirement planning could have a positive impact in many areas of your life. According to a recent survey from AARP and the Ad Council, more than half of people in their 40s and 50s say that feeling more confident about saving for retirement would help them feel less stressed (54%). And 46% would be happier knowing they are taking care of their family’s future. I know I feel better after chatting with Avo at AceYourRetirement.org and making a plan. Now it’s your turn to get a plan.

Just click on this link AceYourRetirement.org and answer a few questions.

Then Avo will give you a plan with tips and information to get started today.

Thanks to AARP and AD Council for developing this useful resource.

What did you learn from Avo?

Share a tip Avo gave you in the comments.

Save for retirement when you’re young. It will be here sooner than you think.

So true. Time flies and the older you get the faster it goes.